In India’s small towns, something big is quietly shifting.

While headlines remain obsessed with Bitcoin bans and Ethereum upgrades, real estate investors in cities like Ambala, Indore, and Coimbatore are silently writing a new story — one that blends the permanence of land with the flexibility of code.

This isn’t just about building homes. It’s about building trust — with the help of blockchain.

Because for millions of middle-class Indians, the dream isn’t to buy crypto.

The dream is to buy a home that no one can fake, fudge, or fight over.

And now, that’s finally possible.

● Tier 2 Cities Are Becoming Blockchain’s Unlikely Battleground

Most people assume that emerging technologies begin in big cities — but in India, it’s often the other way around.

● Smaller municipalities are more open to digitizing land records because there’s less red tape.

● Local developers are hungry for credibility, and blockchain gives them that edge.

● Many buyers are NRIs or first-gen investors who want remote transparency, not just local promises.

● With land being cheaper, pilots for tokenized plots and smart contracts are easier to execute and scale.

When systems are broken or missing, new tech doesn’t disrupt — it simply fits.

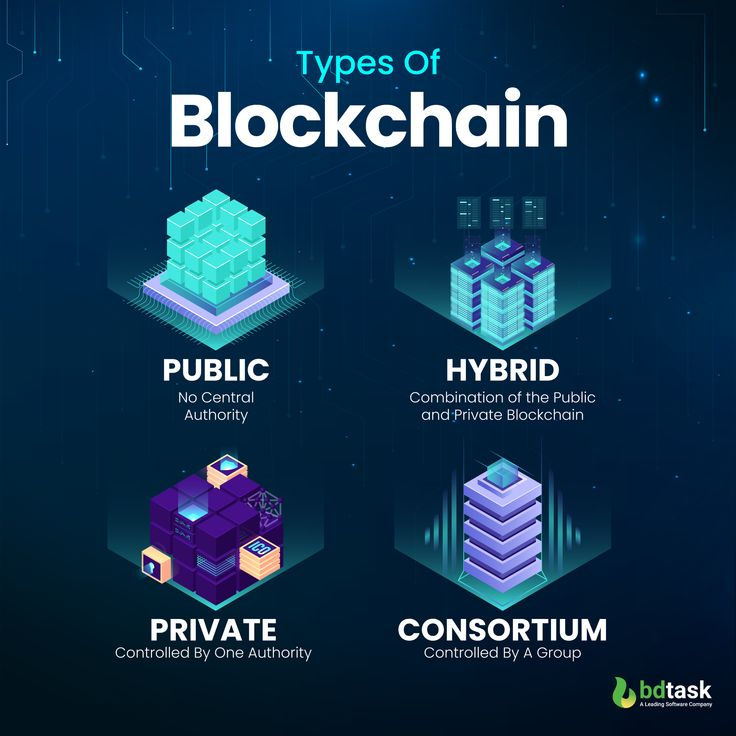

● What Blockchain Actually Changes in Property Deals

You don’t need to understand mining or hash rates. All you need to know is this: blockchain makes real estate tamper-proof, transparent, and time-bound.

● Smart contracts automate builder-buyer agreements — so if the possession date is missed, clauses execute on their own.

● Tokenized property allows multiple people to co-own a plot or project, each with digital proof.

● Blockchain land registries prevent manipulation of records, especially in ancestral or agricultural land.

● On-chain escrows make sure builders are paid only after meeting construction milestones.

● NFT-based property titles act as indestructible ownership certificates, immune to paper fraud or registry theft.

No drama. No disputes. Just code.

● Why Small-Town Buyers Are Already Thinking Like Crypto Users

You won’t find the word “blockchain” on their lips. But their intent is clear:

● They want airtight documentation — not verbal commitments.

● They prefer apps over agents.

● They expect real-time construction tracking and milestone-based payments.

● They’re ready to invest digitally — as long as it’s rooted in real assets like land.

And post-COVID, there’s a new wave of ambition among Tier 2 and Tier 3 Indians — they don’t just want to buy property. They want to build wealth, build safety, and build without fear.

Blockchain offers exactly that.

● Real Examples From the Ground

These shifts aren’t just theory — they’re already quietly shaping real transactions:

● A residential project in Punjab used smart contracts to issue auto-generated builder agreements for each buyer.

● An NRI investor in Australia co-owned a farmhouse outside Ambala via a tokenized digital deed, without ever flying in.

● A housing co-op in Rajasthan used blockchain-based voting to approve society maintenance and budgets — no WhatsApp group drama, just code.

● A Pune startup allowed buyers to own 1/100th of a holiday home in Himachal through token ownership.

No headlines. No announcements. Just slow, irreversible progress.

● Developers Are Playing Catch-Up — But They’re Learning Fast

At first, the idea seemed strange. Builders were hesitant to give away control.

But now? Many developers in Tier 2 cities are embracing it.

● It reduces buyer disputes.

● It brings in NRI money.

● It improves reputation in a market where trust is everything.

● And it attracts younger, digital-first homebuyers.

One small developer in Haryana told us:

“We don’t care what you call it. All I know is — buyers don’t call me anymore to ask when payments are due. The contract tells them.”

● What’s Really Driving This Shift?

● Title insecurity – Decades of fraud, forged documents, and lost registries make blockchain land records more than just useful — they’re necessary.

● Builder distrust – Homebuyers are tired of missed deadlines and legal loopholes.

● Aspiration + technology – UPI has already trained users to trust invisible systems. Blockchain is just the next logical step.

● Urban fatigue – With metros bursting, investors are looking at plots, villas, and gated communities in smaller towns — and want better systems to manage them.

● Real-time accountability – Tech-savvy investors want notifications, dashboards, and automation. Not chai meetings with developers.

● What The Next Five Years Will Look Like

By 2030, here’s what will likely become common across Tier 2 real estate:

● Properties bought, sold, and transferred via verified blockchain titles.

● Tokenized projects where people own 1BHKs or plots collectively.

● Escrow wallets controlled by smart contracts — no release until slab work is verified.

● Transparent societies managed through DAO models — with voting, funds, and disputes handled automatically.

● Multi-generation land records that cannot be tampered with or “lost.”

● Real estate listings that show blockchain-verified ownership history — just like car reports.

And maybe — just maybe — a future where no Indian family needs a lawyer to prove their land is theirs.

● For Architects and Designers: What This Means

This tech isn’t just for developers and buyers. It will deeply impact design professionals too.

● Project proposals may soon be tied to smart contract payment slabs.

● Digital design IP could be locked and protected via blockchain.

● Sustainability data, material use, and energy modeling could be verified and stored on-chain — useful for green certifications.

● Co-living or fractional ownership models will require adaptable designs that function across shared ownership systems.

As the rules of property shift, so must the way we design, deliver, and document our work.

● What’s Holding It Back? (And Why That Won’t Last Long)

Yes, there are roadblocks.

● Most land offices still use paper records.

● RERA hasn’t fully integrated blockchain-based workflows.

● Crypto still faces regulatory fear.

● Most people still think blockchain means Bitcoin.

But here’s the catch: the system doesn’t need everyone to adopt it at once.

It just needs a few to prove it works better.

And that’s already happening — quietly, invisibly — in small-town India.

● Final Thought: Blockchain May Not Change Property Overnight — But It Will Change What Property Means

For centuries, real estate in India has meant risk — of fraud, delay, or loss.

For the first time, technology offers a counterweight.

Not as buzzwords.

Not as speculation.

But as concrete code.

A builder finishes the floor? The buyer pays.

A plot changes hands? It’s recorded instantly, permanently.

A client co-owns a house? Their share is visible, tradeable, and secure.

When cement meets code, something rare happens: people start to trust property again.

Want to Explore Real Estate Design That’s Future-Proof?

At Mishul Gupta Studio, we’re helping clients build homes and projects that don’t just look great — but also embrace new ways of ownership, trust, and smart delivery.

📩 Contact us at contact@mishulgupta.com

🌐 Visit www.mishulgupta.com

📍 Available across Ambala, Chandigarh, Haryana, and pan-India