Introduction

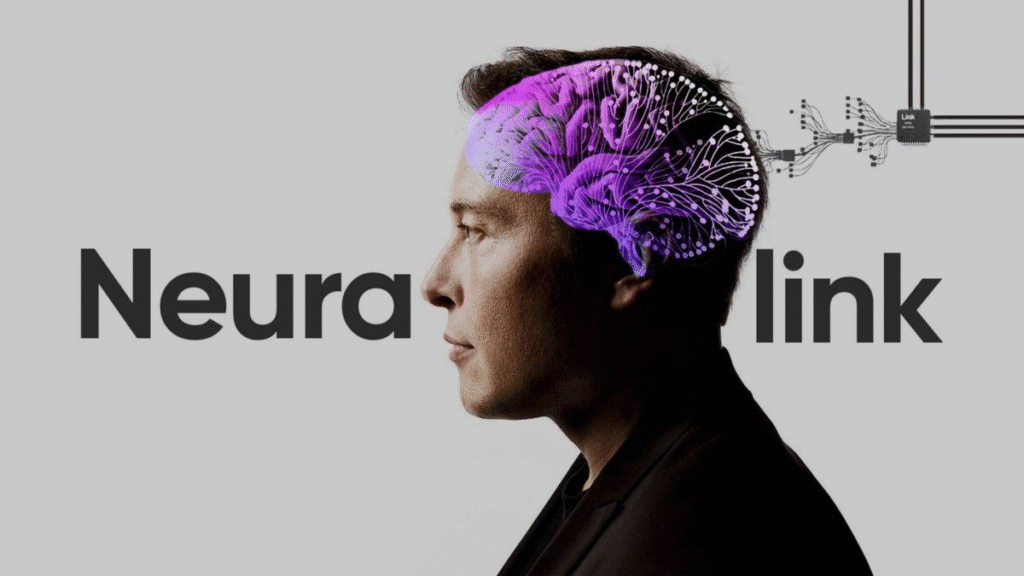

Imagine a future where your path to homeownership and financial wellbeing is guided not just by credit scores and income statements, but by the real rhythms of your mind—your stress levels, risk appetite, subconscious biases, and emotional states—decoded through brainwave technology and artificial intelligence (AI). Welcome to the age of Home Brainwave Finance, where neuroscience, fintech, and smart real estate converge to make the home finance journey radically more personalized, efficient, and equitable.

This revolutionary approach leverages brain-computer interfaces (BCIs), neurofinance insights, and AI-driven decision engines to transform how buyers select mortgages, structure real estate investments, manage property finances, and protect their assets. For the US market, where mortgage complexity, high home prices, and consumer anxiety are especially acute, Home Brainwave Finance offers a leap in transparency, personalization, and profitability—making it a powerful content and monetization opportunity targeting high CPC finance, tech, and real estate sectors.

1. What Is Home Brainwave Finance?

Home Brainwave Finance refers to the use of real-time brainwave analytics, wearable BCIs, and neurofinance principles within the residential finance ecosystem—affecting mortgage applications, approvals, investment decisions, ongoing financial health monitoring, and behavioral coaching.

Instead of relying solely on static financial data (income, debts, credit scores), Home Brainwave Finance employs:

- Wearable neuro-sensors (EEG, fNIRS) that capture brain activity

- AI models that interpret patterns related to stress, focus, risk tolerance, and emotional states

- Smart home integrations that optimize personal financial behavior and environmental comfort

These systems operate both passively—analyzing background brain states—and actively—engaging users via intuitive interfaces—to facilitate smarter, truer decisions and reduce disparities between intention and action.

Why Is This Emerging Now?

- Neurotechnology and AI Maturity: Consumer-grade BCIs and machine learning tools are accessible and reliable enough to interface with finance.

- Increased US Mortgage Complexity: High housing costs and sophisticated financial products demand individualized risk assessment beyond classical metrics.

- Demand for Hyper-Personalization: US consumers expect services tailored to both financial circumstances and psychological profiles.

2. Neuroscience and Technology Foundations

Brainwaves and Cognitive States

Brainwaves reflect neural electrical activity, capturing states such as attention, impulsivity, anxiety, or relaxation. Devices like EEG headsets non-invasively monitor these signals, revealing deep insights about unconscious responses to financial stimuli.

- The amygdala activation signals fear and loss aversion.

- The prefrontal cortex governs planning and risk evaluation.

- Neural oscillations indicate confidence, distraction, or cognitive fatigue.

Brain-Computer Interfaces (BCIs) in Finance

Modern BCIs connect brain activity data with software systems, enabling direct interaction and continuous monitoring. US fintech and real estate startups integrate BCIs for:

- Neural biometric authentication replacing passwords or signatures.

- Emotion-aware risk profiling during mortgage application.

- Real-time behavioral coaching to prevent impulsive financial decisions.

Artificial Intelligence (AI) & Machine Learning Integration

AI platforms analyze brainwave data combined with financial history to:

- Dynamically calculate personal risk profiles for mortgage and investment products.

- Tailor mortgage terms, payment schedules, and insurance options.

- Deliver behavioral nudges or personalized financial education based on neural cues.

3. Applications in the US Mortgage and Homeownership Landscape

Mortgage Application & Approval Made Smarter

Neuro-Risk Profiling:

Applicants enter simulated loan and budgeting scenarios while BCIs record neural reactions to fluctuating interest rates, rates, and repayments—generating precision risk scores reflecting authentic tolerance, not just self-reports.

Personalized Terms and Faster Closing:

AI adapts mortgage offers instantly, aligning down payment, rate types, and term lengths with neural data and credit information, speeding approvals with reduced default risk.

Emotional Co-Piloting:

During contract reviews, BCIs detect confusion or hesitation—activating clarifying videos or live advice, ensuring informed and confident commitments.

Neuromarketing-Enhanced Home Search

- VR Property Tours with EEG Feedback: User brainmaps highlight subconscious affinities or dislikes for layouts, materials, or neighborhood features, informing real-time agent recommendations.

- Custom Campaigns: Advertisements adapt based on positive neural engagement, cutting through overwhelm to boost genuine interest in offers.

4. Financial Health, Budgeting, and Property Management

Neuro-Adaptive Budgeting

- Brainwave-enabled finance apps notice stress build-up during expense planning, prompting tailored reminders or “cool down” breaks.

- Homeowners receive AI alerts when cognitive fatigue signals risk of overspending or missed payments.

Early Warning Systems for Financial Strain

- Opt-in neural monitoring can preempt delinquencies and foreclosures by signaling stress-related behavioral shifts, enabling lenders to intervene with restructuring or assistance.

Personalized Coaching & Behavioral Change

- Long-term use of neurofeedback trains users to recognize anxiety or impulsive tendencies, strengthening financial resilience and decision-making.

5. Neurofinance-Backed Investment Platforms and REITs

- Brainwave-Guided Crowd Investing: Real estate crowdfunding websites match portfolios dynamically to investors’ neural risk profiles, minimizing poor choices.

- Algorithmic Trading: Hedge funds use traders’ brain states to optimize execution timing and risk exposure, reducing emotional trading losses.

6. Ethical, Privacy, and Regulatory Considerations in the US

Data Privacy & Consent

- Brainwave data is deeply sensitive; user consent must be explicit and granular.

- HIPAA-style data security frameworks and encryption are mandatory for storage and transmission.

- Transparent audits ensure consumer trust.

Fairness and Accessibility

- Algorithms must avoid bias—especially for neurodiverse and disadvantaged populations.

- Neurodata-based finance aims to increase access to homeownership by authentic risk profiling beyond credit scores.

Emerging US Regulations

- State-level laws (e.g., Colorado’s biometric privacy act) set precedence for neurodata protection.

- National regulation is evolving to address these novel data types responsibly.

7. Why Home Brainwave Finance Is a Lucrative US Market Niche

Monetization via Ad Placements

- Position ads above the fold, in-article, and use responsive sizes to maximize CTR and revenue.

- Incorporate interactive tools (e.g., personalized risk scoring calculators) to boost engagement, session duration, and page views.

US Market Growth Drivers

- Complex US mortgage landscape with demand for innovative differentiation.

- Growing curiosity and investment in neurotechnology and AI-driven personal finance.

- Strong content appetite for fintech innovations, neuroscience applications, and real estate tech.

8. Challenges and the Path Forward

Technical Complexity

- Ensuring robust BCI signal quality and integration with finance platforms.

- Multi-vendor ecosystem management and data standardization.

Consumer Education & Adoption

- Creating approachable UI/UX and educational content for diverse users, especially older Americans and first-time buyers.

Ethical AI Oversight

- Third-party audits and transparency on algorithm design and decisions.

Conclusion

Home Brainwave Finance is set to revolutionize the US real estate and mortgage market by embedding the brain at the core of financial decision-making. By combining cutting-edge neuroscience, AI, and fintech, it offers a pathway to more authentic, efficient, and inclusive homeownership—powered by data from the most personal source: the human mind.

For content platform operators, fintech innovators, real estate professionals, and investors in the US, Home Brainwave Finance is a high-value, high-traffic niche ripe for optimized SEO, targeted monetization, and sustained growth.

For expert consultation, platform integration, or content strategy focused on Home Brainwave Finance targeting US audiences, please contact:

Mishul Gupta

Email: contact@mishulgupta.com

Phone: +91 94675 99688

Website: www.mishulgupta.com