Introduction: The Dawn of Quantum Real Estate Planning

In today’s rapidly evolving world, traditional real estate planning faces mounting challenges—from urban complexity and climate change to data explosion and rising investor expectations. Amidst these pressures, a transformative new paradigm is emerging: Quantum Real Estate Planning. This approach applies the groundbreaking power of quantum computing to all aspects of real estate investment, development, risk management, urban design, and asset optimization—offering solutions that were previously impossible with classical technologies.

Quantum real estate planning harnesses the unique properties of quantum bits (qubits), such as superposition and entanglement, to perform calculations on an unprecedented scale and at unthinkable speeds. By enabling planners, investors, and policymakers to analyze and optimize the vast web of factors driving real estate today, quantum technologies are set to reimagine how we plan, build, and inhabit the spaces of tomorrow.

1. What is Quantum Real Estate Planning?

Quantum real estate planning refers to the use of quantum computing and quantum-inspired algorithms to improve the accuracy, efficiency, and flexibility of decisions in urban development, asset management, investment, and operations. It is not simply about powerful number crunching; it’s about fundamentally re-architecting real estate workflows to leverage:

- Complex scenario modeling involving thousands of variables (market trends, regulatory shifts, climate risk, consumer behavior, construction costs, etc.).

- Real-time optimization of site selection, project timing, asset allocation, and district-wide energy distribution.

- Simulation of emergent phenomena in dense urban environments that previously defied classical computation.

- Enhanced risk assessment that can simultaneously evaluate interconnected hazards and financial implications.

This holistic, data-driven vision is beginning to disrupt the conventional boundaries between finance, technology, engineering, and planning in the built environment.

2. How Quantum Computing Works in Real Estate

Quantum vs. Classical Computing

While classical computers rely on bits (0 or 1), quantum computers manipulate qubits that can exist in multiple states at once. With superposition, qubits perform many calculations in parallel; entanglement allows for correlations that enable exponential increases in processing power.

In real estate, these quantum properties enable:

- Multi-factor optimization: Analyzing all possible combinations of variables that impact investment and development, rather than relying on linear, stepwise methods.

- Complex network simulation: Modeling the interactions between urban systems (transport, utilities, demographics) with levels of detail and nuance previously impossible.

Quantum Algorithms in Practice

- Quantum Approximate Optimization Algorithm (QAOA): Used for optimizing large, complex systems like city traffic flow, site layouts, and supply chains.

- Quantum Monte Carlo Simulation: Allows risk analysts to run thousands of stochastic scenarios simultaneously for robust investment planning.

- Quantum-Enhanced Machine Learning: Processes massive datasets to detect patterns and trends in buyer behavior, price movement, and market volatility.

- Quantum-Resistant Blockchain: Secures digital real estate transactions against future quantum threats by deploying quantum-safe cryptography.

3. Key Applications and Use Cases

a) Predictive Modeling & Market Forecasting

Quantum computers analyze myriad variables affecting real estate—from GDP growth and demographic shifts to global crises—in real time, producing hyper-accurate forecasts for pricing, demand, and feasibility.

Example: A developer in Singapore uses quantum-powered models to simulate how emerging climate risks and labor market shocks could influence condo demand and pricing strategies for the next decade.

b) Risk Assessment and Insurance

Quantum risk assessment evaluates property risks in unprecedented detail: factoring in dynamic climate projections, geospatial data, neighborhood crime rates, infrastructure stress, and more—leading to smarter insurance premiums and better risk mitigation.

Example: Insurers employ quantum models to analyze flood, fire, and earthquake risks to set property insurance rates dynamically, reducing uncertainty for both property owners and underwriters.

c) Portfolio Optimization

Quantum algorithms optimize investment portfolios, balancing risk/return across asset types, geographies, and holding periods far more efficiently. Institutional investors are already piloting quantum portfolio optimization to maximize long-term returns.

Example: A real estate fund uses quantum-enhanced optimization to reallocate assets weekly, factoring in micro-market shifts, regulatory updates, and emerging ESG criteria.

d) Urban Planning & Smart Cities

Quantum tools process colossal urban data—from traffic and energy consumption to waste management and social dynamics—to optimize zoning, transportation, and infrastructure investment. This means more agile, sustainable, and adaptive city design.

Example: City planners simulate how a new metro line will affect population flows, energy demands, and economic growth using quantum-powered city models.

e) Climate Modeling & Resilience

By ingesting global climate models, carbon data, local environmental impacts, and urban growth scenarios, quantum systems help planners design buildings and districts with enhanced climate resilience.

Example: Municipalities run quantum simulations to assess how sea level rise or heat waves will alter real estate values and infrastructure needs over future decades.

f) Blockchain Security and Real Estate Tokenization

Quantum-safe blockchain protocols are being developed to secure property titles, transaction records, and digital assets against future quantum hacks—safeguarding the coming wave of property tokenization, DeFi, and fractional ownership.

4. The Future of Data Centers and Real Estate Markets

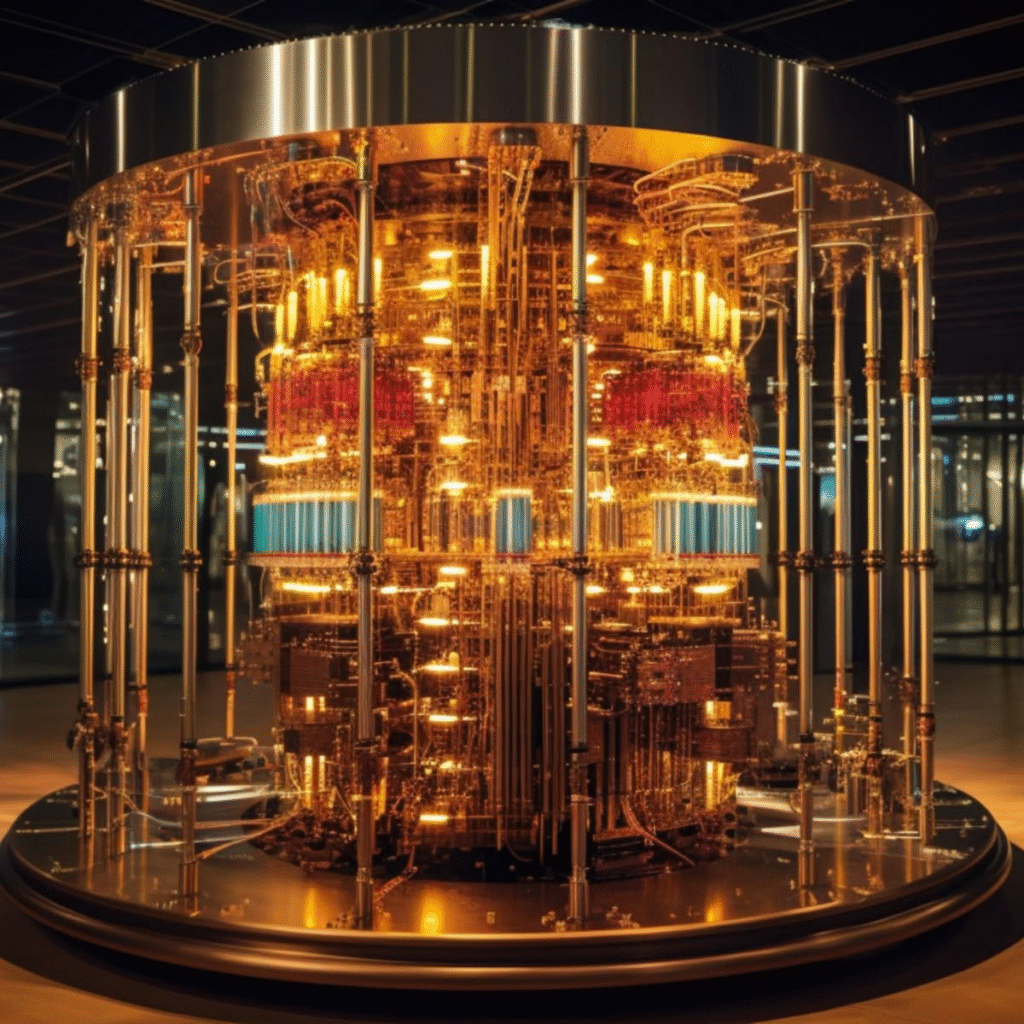

Quantum computing is already reshaping how data centers are designed and built:

- Massive hybrid data centers (housing both classical and quantum tech) are springing up in global tech hubs.

- Real estate developers who anticipate and build facilities with quantum-ready infrastructure are gaining a “first-mover advantage.”

- Investment in quantum-enabled real estate is projected to accelerate, mirroring the AI/data boom of the last decade.

5. Challenges and Considerations

Despite explosive potential, quantum real estate planning faces bottlenecks:

- Cost and Scale: Current quantum hardware is expensive and limited, but costs are expected to fall as technology matures.

- Expertise: Interdisciplinary teams are needed, combining quantum computing, urban design, economics, and data science.

- Data Privacy: With quantum’s power to pierce encryption, new privacy protocols and regulations are essential.

- Regulatory and Market Readiness: Governments and industry must adapt policies, standards, and education for quantum’s integration.

6. A Decade-Long Roadmap: Where Are We Headed?

By 2030

- Quantum Infrastructure: Most new data centers and smart city projects incorporate quantum-ready components.

- Mainstream Adoption: Quantum planning tools become standard in major real estate and urban planning firms.

- Hyper-Personalized Development: Predictive analytics allow micro-targeted real estate products and designs tailored to evolving user demand and sustainability goals.

- Global Quantum Ecosystems: Investment hubs emerge in North America, Europe, and Asia, with quantum-skilled real estate professionals in high demand.

7. Strategic Advantages: Why Plan Quantum Now?

- Competitive Edge: Early adopters gain superior accuracy, agility, and insight—outperforming traditional rivals.

- Resilience: Better risk management in the face of climate volatility, regulatory shifts, and market shocks.

- Sustainability: Optimized resource allocation and urban form support net-zero and livable communities.

- Security: Stay ahead with quantum-resistant transaction protocols and tokenized asset models.

8. Real-World Case Studies

- JLL Quantum Real Estate Reports: Predict $10–$20 billion annual quantum investment by 2030, with major real estate groups already developing quantum expertise and infrastructure.

- Goldman Sachs Quantum Labs: Testing quantum optimization for real estate and finance portfolios, reporting significant speed and accuracy gains.

- City Science Labs (MIT): Quantum simulations for optimizing complex urban plans, from energy use to transportation mapping and social networks.

- Climate Risk Quantum Analytics: Insurers and city governments adopting quantum models for resilience planning and insurance pricing.

9. The Path Forward: Getting Quantum-Ready

Professionals, developers, and urbanists looking to benefit should:

- Invest in quantum computing education and partnerships.

- Start integrating quantum-inspired algorithms (even before full quantum hardware arrives).

- Upgrade digital infrastructure for hybrid quantum-classical computation.

- Engage in pilot projects for quantum asset management, risk modeling, or urban simulation.

- Collaborate in interdisciplinary teams (physics, data science, real estate, urban planning).

Conclusion: The Quantum Age of Real Estate

Quantum Real Estate Planning is more than a technological upgrade—it’s a conceptual and practical shift driving a new era of precision, agility, and foresight in the built environment. With its unparalleled analytical power and capacity for scenario exploration, quantum technology will empower us to build more resilient cities, optimize value, and navigate a future of complexity with confidence.

Those who invest intellectually and operationally in quantum today will help build the places that tomorrow’s world will need—connected, adaptive, and ready for whatever comes next.

For expert consultation or collaboration on Quantum Real Estate Planning and technology-driven development strategies, contact:

Mishul Gupta

Email: contact@mishulgupta.com

Phone: +91 94675 99688

Website: www.mishulgupta.com