Introduction

As traditional models of real estate ownership evolve, new frameworks are emerging that challenge the conventional paradigm of buying and selling property outright. One such innovation is subscription-based property rights, a concept that offers a dynamic, flexible approach by allowing users to access and utilize properties through recurring payments rather than full upfront purchase. This model reflects broader societal shifts towards subscription services and access-based economies, reshaping how people relate to residential, commercial, and mixed-use real estate.

Subscription-based property rights introduce a transformative way for developers, investors, and users to engage in property markets. Rather than full ownership transfers, these arrangements grant rights over property use or fractional interests via ongoing subscriptions. This system provides a steady revenue stream for owners while lowering barriers for consumers, enabling lifestyle flexibility and fostering novel community dynamics.

This comprehensive article explores the nature of subscription-based property rights, their legal and economic foundations, implications for stakeholders, challenges to adoption, and the technological enablers shaping their future. Through analysis and case studies, we consider how this evolving model may contribute to a more accessible, resilient, and sustainable real estate landscape.

Understanding Subscription-Based Property Rights

The Concept and Models

Subscription-based property rights represent a departure from full ownership by emphasizing use rights or fractional stakes granted through periodic payments. Unlike traditional ownership, where a one-time purchase confers indefinite rights, subscription models keep ownership centralized or divided among multiple parties while offering subscribers rights to occupy, use, or profit from a property for a defined period — typically renewed monthly, quarterly, or annually.

Primary subscription models include:

- Full Subscription Access: Users pay for the right to live or operate in a property without owning title, often with options for upgrades, services, or buyout clauses.

- Fractional Ownership Subscription: Multiple subscribers collectively own fractions of a property, each entitled to usage proportionate to their stake, governed by contractual agreements.

- Real Estate Syndication Subscription: Investors buy into real estate syndicates via subscriptions, providing capital for acquisition and development while participating in profits without singular property control.

These models differ significantly from conventional sales, leases, or rentals, blending aspects of ownership, tenancy, and shared economy participation.

Comparison to Traditional Models

| Feature | Conventional Ownership | Lease/Rental | Subscription-Based Rights |

|---|---|---|---|

| Ownership Title | Full transfer | None | Varies (centralized or partial) |

| Upfront Cost | High | Moderate | Lower, recurring |

| Usage Flexibility | Fixed | Contractual | High, customizable |

| Maintenance Responsibility | Owner | Landlord | Usually bundled or shared |

| Transferability | High | Limited | Somewhat flexible |

| Community Engagement | Variable | Usually Low | Often encouraged |

Subscription property rights blur lines between renting and owning, offering tailored access while lowering financial and operational burdens for users.

Legal and Contractual Frameworks

Developing and managing subscription-based property rights requires robust legal agreements that clarify roles, rights, and responsibilities.

Subscription Agreements

At their core, these are contracts outlining the terms of subscription use, including:

- Duration of access with renewal options

- Subscription fee structure and payment terms

- Rights of property use and restrictions

- Maintenance, repair, and service provisions

- Procedures for dispute resolution, termination, or exit

- Allocation and share of profit or equity dividends (in fractional cases)

- Privacy, data use, and behavioral policies (if applicable)

Such agreements provide legal protections for both subscribers and owners, reducing disputes and ensuring regulatory compliance.

Regulatory Considerations

Subscription arrangements may trigger specific statutes depending on jurisdiction, touching on:

- Tenancy and lease laws

- Securities regulation (when structured as fractional ownership)

- Consumer protection frameworks

- Tax implications for income recognition and property valuation

- Zoning and occupancy controls

Navigating these rules demands interdisciplinary legal expertise, especially as subscription models intersect property and financial regulations.

Business and Economic Implications

Revenue Predictability for Owners

Subscription models generate steady, recurring revenue, reducing dependence on lump-sum sales or spot leasing markets. This cashflow smoothing supports financial planning, development funding, and operational stability.

Lower Barrier to Entry for Users

By replacing high upfront purchase prices with manageable periodic fees, subscriptions enhance accessibility, especially for demographics unable or unwilling to commit to full ownership.

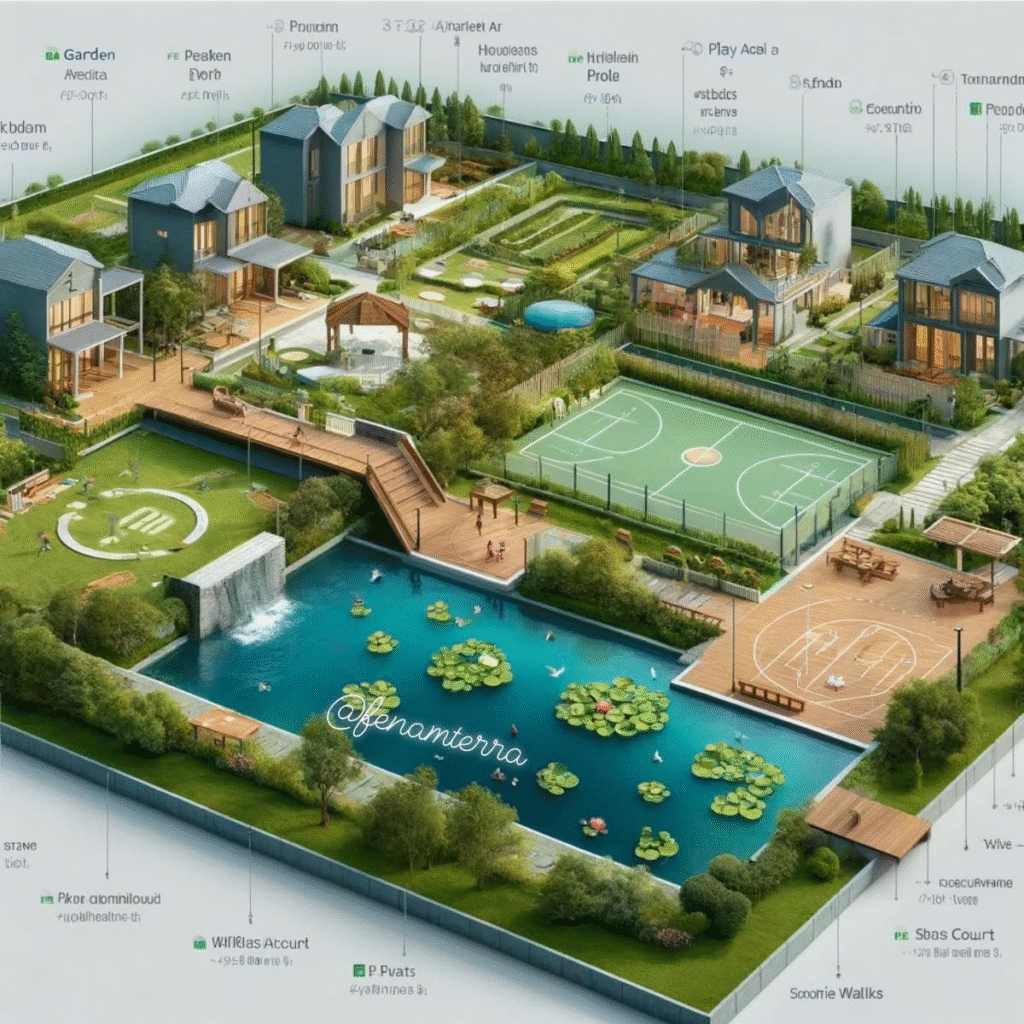

Community and Experience Building

Subscription arrangements often facilitate shared services, amenities, and community engagement, especially in co-living, co-working, and lifestyle developments, enhancing user satisfaction and retention.

Impact on Market Liquidity

Depending on structure, subscription rights can improve market liquidity by enabling easier transfer of usage rights or fractional stakes via digital marketplaces or platforms.

Benefits for Stakeholders

For Consumers and Subscribers

- Affordability: Reduced capital expenditures and flexible commitment duration.

- Flexibility: Ability to relocate or adjust subscription tiers aligned with changing life circumstances.

- Access to Services: Often bundled with maintenance, amenities, or smart home technologies.

- Community: Participation in collaborative living or working environments.

For Property Owners and Developers

- Sustained Revenue: Subscription fees contribute ongoing income beyond sales.

- Risk Mitigation: Spreads financial risk over multiple subscribers instead of relying on single buyers.

- Operational Control: Owners can retain asset control while monetizing rights.

- Sustainability: Longer-term occupancy reduces turnover-related costs and resource usage.

For Investors

- Diversification: Participation in real estate through subscription syndicates broadens investment portfolios.

- Reduced Entry Cost: Fractional access lowers capital thresholds.

- Liquidity: Emerging secondary markets for subscription interests improve exit options.

Challenges and Limitations

- Complex Legal Structures: Drafting binding agreements balancing rights, obligations, and exit mechanisms is non-trivial.

- Market Acceptance: Consumers may resist perceived limits to exclusive ownership or feel uneasy with shared rights.

- Pricing Sustainability: Over lengthy periods, total subscription costs may exceed traditional purchase price, requiring clear value positioning.

- Operational Complexity: Managing subscriptions—including billing, maintenance, dispute resolution—demands advanced platforms and customer service.

- Regulatory Ambiguity: Existing property, securities, and tax laws may not fully accommodate subscriptions, creating uncertainty.

Case Studies and Industry Examples

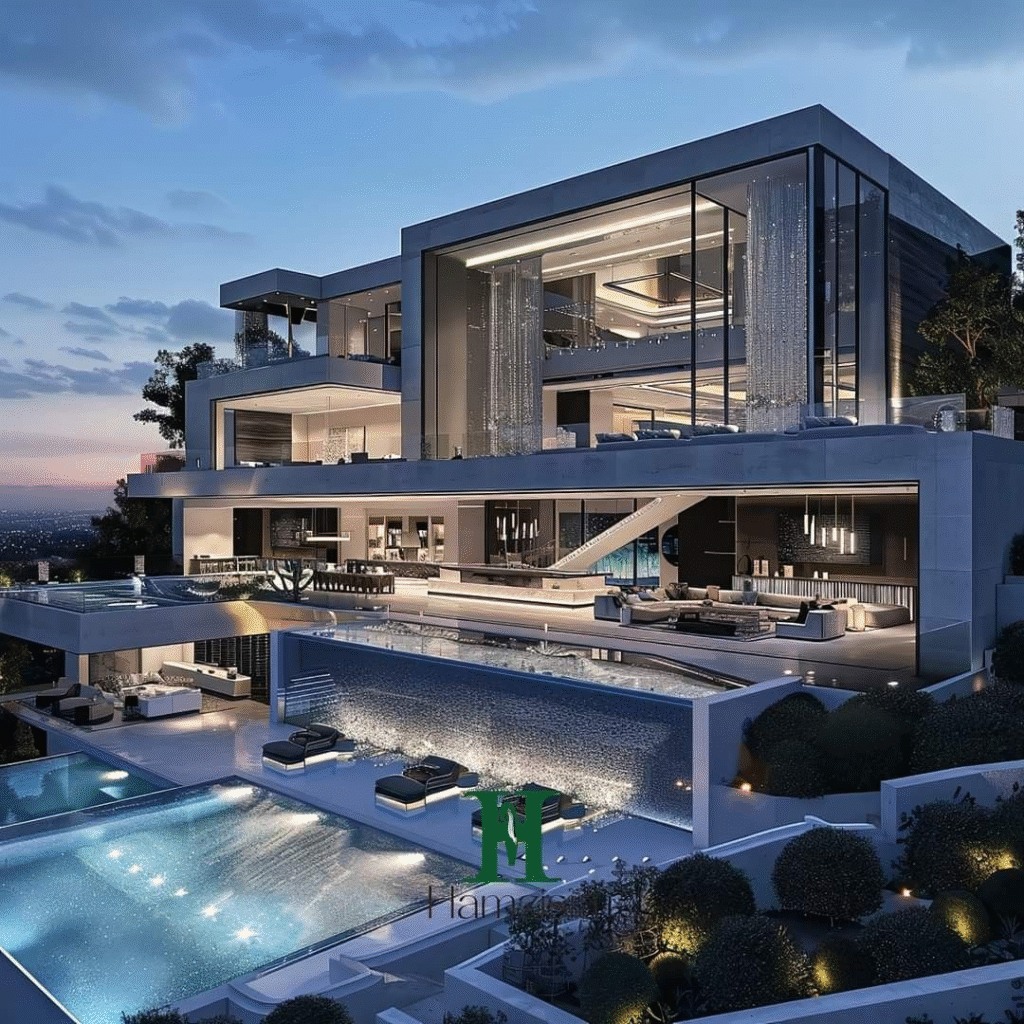

- Subscription Living Platforms: Developments offering furnished, fully serviced apartments on subscription, targeting urban professionals seeking flexibility.

- Real Estate Syndications: Investors subscribing to shares in multifamily or commercial projects, participating in income and appreciation without direct management.

- Fractional Vacation Homes: Subscribers gain shared usage rights in resort properties with subscriptions tiered by terms and access.

- Co-Living Developments: Longer-term subscriptions integrating private spaces, shared amenities, and community programming for millennials and digital nomads.

Technological Enablers and Innovations

- Subscription Management Platforms: Software automating subscriber onboarding, fee collection, property access, and renewals.

- Blockchain and Tokenization: Decentralized ledgers enabling transparent ownership records, fractional shares, and secondary trading of property rights subscriptions.

- AI and Analytics: Optimizing subscription pricing, personalized offers, and predicting churn for improved retention.

- Smart Home Integration: Enhancing value with technology-enabled services and usage monitoring.

Future Trends and Prospects

- Expansion Beyond Residential: Subscription rights to commercial offices, retail spaces, and mixed-use developments.

- Hybrid Ownership Models: Combining subscription rights with partial ownership or rent-to-own frameworks.

- Global Market Growth: Particularly in high-density urban centers adapting to changing lifestyles and housing affordability challenges.

- Regulatory Evolution: Emerging laws recognizing subscription models and defining parameters for consumer protection and taxation.

- Sustainability Focus: Aligning subscriptions with environmental goals by enabling efficient use and resource-sharing.

Conclusion

Subscription-based property rights represent a profound shift in how real estate is conceived, transacted, and experienced. By redefining ownership as flexible access and participation, these models offer compelling advantages in affordability, revenue stability, and lifestyle adaptability. Yet, they also raise complex legal, operational, and perceptual challenges requiring careful design, transparent communication, and supportive regulation.

As subscription models integrate advanced technology, legal innovation, and market experimentation, they promise to complement traditional ownership and leasing — potentially becoming a cornerstone of future housing and commercial real estate ecosystems. Stakeholders who embrace this transition stand to unlock new value, broaden access, and foster resilient, community-oriented environments.

For expert consultation on subscription-based property rights, legal frameworks, technology integration, and market entry strategies, please contact:

Mishul Gupta

Email: contact@mishulgupta

Phone: +91 94675 9988

Website: www.mishulgupta.com